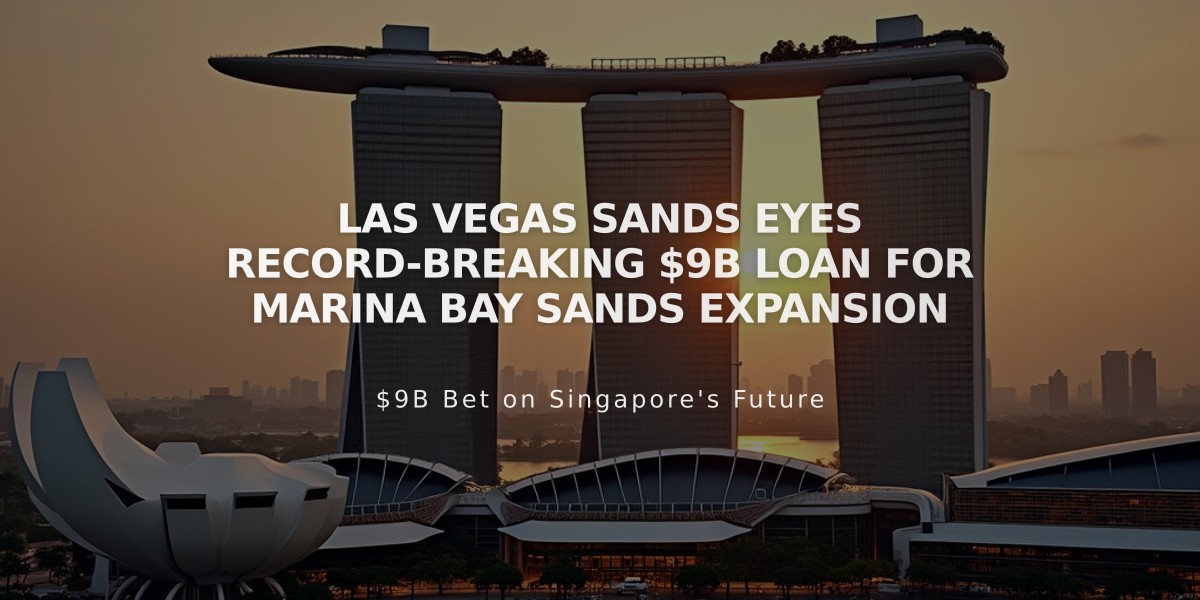

Las Vegas Sands Eyes Record-Breaking $9B Loan for Marina Bay Sands Expansion

Las Vegas Sands' Marina Bay Sands (MBS) is reportedly seeking a $9 billion loan to fund its Singapore expansion plans, potentially marking the largest corporate credit extension in Singapore's recent history.

Marina Bay Sands hotel at night

Major financial institutions including DBS Group Holdings Ltd., Malayan Banking Bhd., Oversea-Chinese Banking Corp., and United Overseas Bank Ltd. are reportedly structuring the seven-year loan and seeking additional contributors.

Las Vegas Sands maintains investment-grade credit ratings, though only by one notch at major agencies. Moody's Investors Service predicts the company's retained cash flow to net debt ratio could increase to 33% over the next 12-18 months, while maintaining sufficient resources for dividends and share repurchases.

The expansion costs have risen significantly from initial estimates of $3.37 billion, largely due to global materials shortages and tight labor markets. The proposed loan would partially refinance a $2.98 billion loan from 2019, with remaining funds directed toward expansion efforts.

The expansion project includes:

- New guest rooms

- Additional convention and meeting space

- 15,000-seat entertainment arena

- Projected completion by 2031

This investment comes at a crucial time as regional competition intensifies, with upcoming casino developments in Japan (MGM Osaka) and Thailand. While Singapore currently ranks as the world's third-largest gaming market by gross gaming revenue (GGR), Thailand could potentially overtake this position with its multiple planned casino developments.

Marina Bay Sands, one of only two integrated resorts in Singapore, remains one of the world's most profitable casino hotels, drawing visitors from across Asia. Despite the substantial investment required, the expansion is positioned to maintain MBS's competitive edge in the evolving Asian gaming market.

Related Articles

Atlantic City Casino Workers Urge Gov. Murphy to Address Indoor Smoking Ban in State Address