DraftKings Executives Offload $206M Worth of Company Stock in 2024

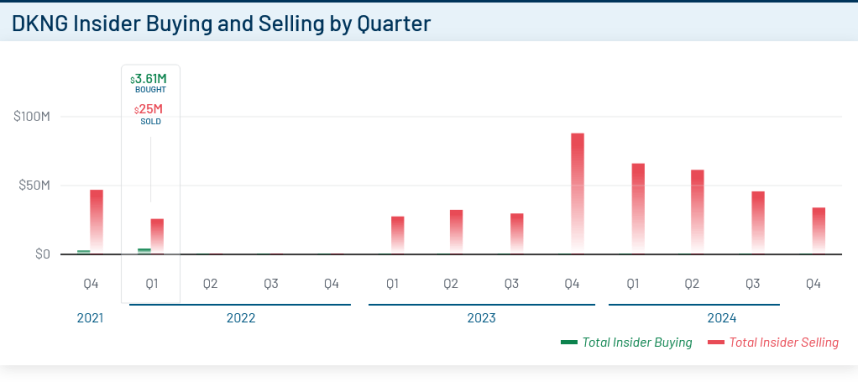

DraftKings insiders sold $205.54 million worth of company shares throughout 2024, with sales declining each quarter. The first quarter saw $66 million in sales, followed by $61 million in Q2, $45 million in Q3, and $34 million in Q4.

Chief Legal Officer R. Stanton Dodge and co-founder Paul Liberman made significant sales in December, totaling over $30 million. Notably, all 20 insider transactions in 2024, including those by CEO Jason Robins and other co-founders, were sales with no purchases.

The extensive insider selling coincided with DraftKings' underwhelming stock performance, which rose only 5.53% in 2024. This significantly trailed behind major indices:

- S&P 500: +25%

- Nasdaq 100: +25%

- S&P Select Sector Consumer Discretionary: +25%

- Flutter Entertainment (FanDuel parent): +44.39%

DKNG insider trading activity chart

In contrast, DraftKings' competitors showed different patterns:

- Flutter Entertainment: No insider transactions in the past three months

- Caesars Entertainment: Less than $350,000 in insider sales, with executives buying more than selling in H1 2024

- Penn Entertainment: $2.61 million in insider purchases vs. $126,578 in sales, with buys outnumbering sales 4-to-1

Flutter announced a $5 billion share repurchase program in September, while DraftKings announced a smaller $1 billion buyback plan in August.

Related Articles

Atlantic City Casino Workers Urge Gov. Murphy to Address Indoor Smoking Ban in State Address